A few weeks ago, we challenged distributors to test how well they really knew their buyers. Using data we collected from a buyers' survey, we asked distributors to guess the answers buyers gave. Only 3% of participants got all 3 questions correct, and 16% actually got all 3 questions wrong!

Read below to see how the two groups compared, or if you'd like to test your own knowledge, you can visit the original quiz here (then come back for the answers!).

Question 1

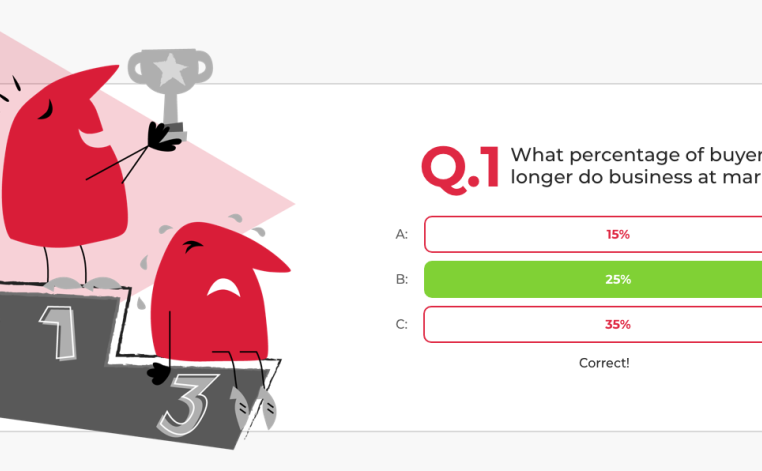

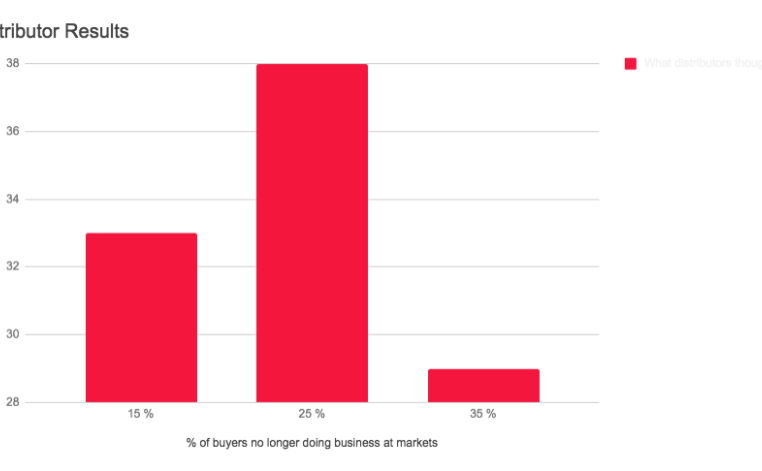

Question 1 asked what percentage of buyers no longer do business at markets

Distributor Results - Question 1

Although there's actually a fairly even split between what distributors thought, over two thirds have gone for 25% / 35% - so it's clear that the majority of distributors are aware that buyers are doing less business at markets. But by no means does that mean markets are any less important, just that the role of them is changing. As we spoke about in our ‘What Does The Future Hold For Major Markets’ blog, due to the rise in coproductions & partnerships, strong relationships are more essential than ever before. Markets are critical in facilitating strong relationships, as they offer up a dedicated place and time for people across the globe to meet.

Question 2

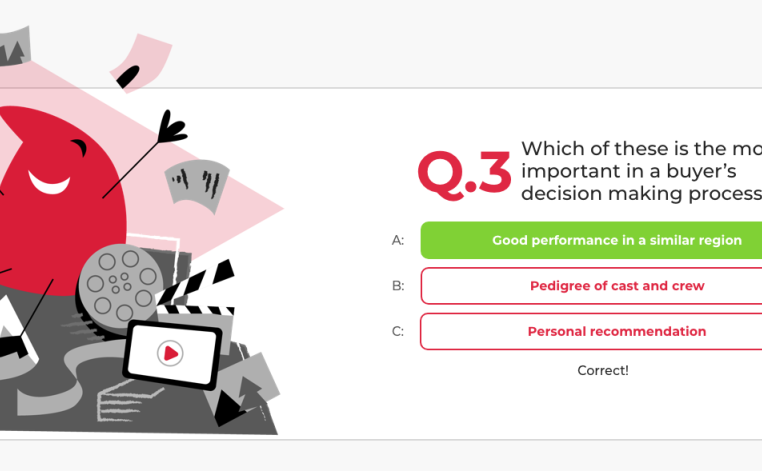

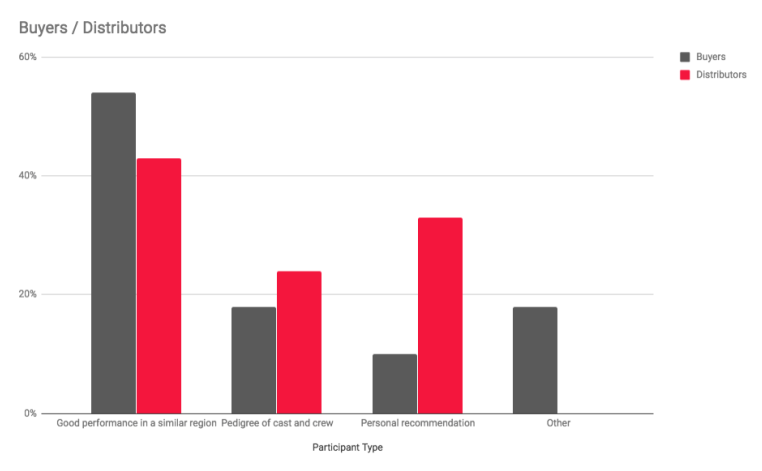

Question 2 asked distributors what they thought the most important element is in a buyer's decision making process.

Distributor Results - Question 2

Over 50% of distributors correctly guessed that the more important factor in a buyer’s decision-making process is programmes perform in similar regions. However, it’s interesting to note that a third of distributors overestimated the influence of ‘personal recommendations’, and thought they would be the highest valued, when in fact only 11% of buyers ranked it top.

Question 3

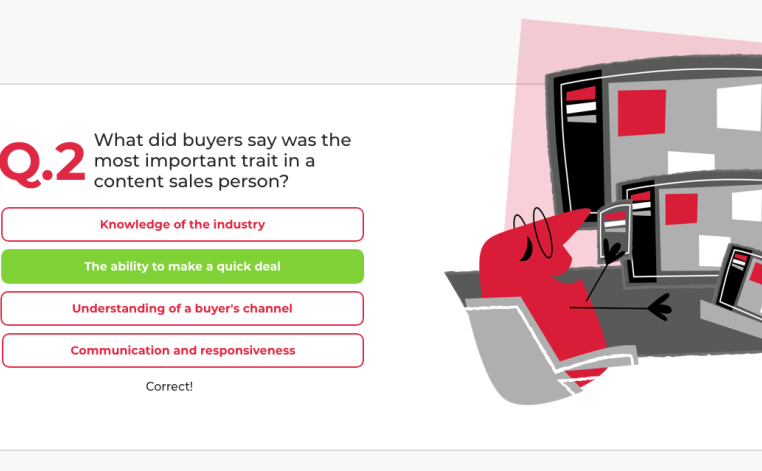

Question 3 asked distributors to guess what buyers chose as the most important trait in a sales person.

Distributor's Response

With less than a fifth of distributors correctly guessing that the ability to make a quick deal is the thing buyers value most, there’s a clear disconnect. While buyers do value understanding, knowledge and communication, it’s secondary to ‘quick deals’, which reflects the frustration buyers may have with the complex process of acquiring new content.